| Basic Information | Lee Shau Kee | Li Ka-Shing | Henry Cheng | Joseph Lau |

| Nationality | Hong Kong | China/Canada / UK | China, Hong Kong | Hong Kong / United Kingdom |

| Date of Birth | 7th March 1928 | 13th June 1928 | 11th September 1946 | 21st July 1951 |

| Place of Birth | Shude, Guandong, China | Chao’an Chaozhou, Guangdong, China | Shunde, Guangdong, China | Hong Kong |

| Age | 92 years old | 92 years old | 73 years old | 69 years old |

| Status | Businessman | Businessman | Businessman | Businessman |

| Occupation | Henderson Land Development. Hong Kong and China Gas. | Li ka-Shing foundation | Jewelry makers | Real estate investor |

| School / College | China Academic Social Science, Doctor of Business Administration from 1945 – 1949 | He compelled to leave school for income at the age of 16 years | N / A | N / A |

| Graduation | The Chinese University of Hong Kong, Doctor of Law from 1973 – 1975 | He did not graduate from any University. | University of Western Ontario | University of Waterloo, Kitchener, ON, CA |

| Career | He started his career from 1964 – 1969 chairman, Hong Kong & China Gas | He started his career from the Harvard Business School | He was the best Jewelry maker. | He started his career with the 61% stake in Chinese Estate Holdings |

| Net worth | $30.1 Billion (2019) | $24.8 Billion (May 2020) | $20.7 Billion | $16.9 Billion |

| Famous for | Founder and former long-time Chairman of Henderson Land Development. ex-Chairman of Hong Kong and China Gas. | Li Ka Shing Foundation | Jewelry making in all over the world. | Real Estate investor |

| Investments | Real estate, ports, electricity, telecommunications, internet, and many others | 67 percent stake in Chow Tai Fook Jewelry, 33 percent stake in New World Development, 75 percent of Chow Tai Fook Enterprises, 18 percent of Giordano International, 2 percent of Ping An Insurance. | Lau owns a 61% stake in Chinese Estates Holdings. | |

| Philanthropist | Lee Shau Kee Foundation more than HK$20 million, The University of Hong Kong donated about HK$500 million, Hong Kong University of Science and Technology donated about HK$400 million, Yuen Long area to Charity organization Po Leung Kuk, Donated about HK$100 million to Hang Seng Management College. | SMEs in Hong Kong of HK$1 billion (October 2019), experimental education and exchange program (September 2019), Institute for Synthetic Biology at Hong Kong University of Science & Technology (HK$500 million, August 2019), Shantou University, and the Shantou University Medical College (1981), Tsz Shan Monastery Buddhist Art Museum at the Tsz Shan Monastery (HK$3 Billion, since 2003), transcatheter cardiovascular interventions subsidy program at the Hong Kong Sanatorium and Hospital (HK$10 million, February 2019) and many more works worked by him. | N / A | N / A |

| Awards | N / A | Justice of the peace (1981)LL.D. (1986)D. SSc (1994)KBE (2000)GBM (2001) | N / A | N / A |

Lee Shau Kee:

Lee Shau Kee was born on 29th January 1928 in Hong Kong, China. He is also known to be as “Uncle Four”, He is one of the very few fourth-born children in the world to have become a multi-billionaire. He got his early education from the local school of China & completed his doctorate of Business administration from 1945 – 1949 from China Academic Social Sciences. Then he completed his doctorate of law from the Chinese University of Hong Kong from 1973 – 1975. He started his career from 1964 and became the chairman in Hong Kong & China Gas till 1949. After that, he became chairman of Henderson Land Group from 1976 – 2000, Managing Director, Henderson Land Group from 1976 – 1997, Vice Chairman of Sun Hung Kai Properties from 1987 – 2000, chairman of Henderson Cyber Limited from 1991 – 2000, With Henderson Land Development Hong Kong from 2000 – 2013, director of Hong Kong Ferry (Holdings) Company Limited from 2000 – 2013[1].

Hong Kong-based land magnate and larger part proprietor of Henderson Land Development, a property aggregate with interests in properties, inns, eateries, and internet providers. As of October 2012, as per the Bloomberg Billionaires Index Lee is recorded as the nineteenth most extravagant individual on the planet. His riches are assessed to be $24 billion and positioned as the second wealthiest man in Hong Kong after Li Ka Shing. Lee Shau got an insightful business mind and is celebrated for exhorting speculators’ effectively and even cautions individuals not to put resources into his organization if he predicts any danger to their venture. Kee’s unassuming help to the Chinese University of Hong Kong has profited in instructing numerous Hong Kong residents. Dr. Lee through the Lee Shau Kee Foundation gives a significant sum in magnanimous deeds[1].

Li Ka-Shing:

Li Ka-Shing was born on 29th July 1928 in Chao’an Chaozhou, Guangdong, China. He is a Hong Kong businessperson and humanitarian and one of the strongest folks in Asia. He is similarly one of the most dominant capitalists in the whole Asian Subcontinent. He was one of the Chairman of the board of the now-defunct Hutchison Whampoa Limited (HWL) and he is now serving as the Chairman of Cheung Kong Holdings, and one of the Hong Kong’s leading multi-national corporations. He has business in many fields such as real estate, ports, electricity, telecommunication, and the internet. He was from China and his family was the modern means and his father, a teacher, headed a local primary school. He grew up in a period of great political turmoil in China. His father died when he was at the age of 15 years old and left the school for getting income and started working for the family. He worked for 16 hours a day and proved to be a capable salesman. He got experience in plastic industries and opened his own business in 1950. From the 1950s the company became steady growth and Li began looking for opportunities to expand the business. He buys the first factory in 1958 and became the first real estate investment. The business thrived over the following years and the company was renamed Cheung Kong Holdings in 1971, it was listed on the Hong Kong Stock Exchange in 1972[2].

He long-drawn-out his commercial by receiving Hutchison Whampoa from HSBC in the year 1979. This additional various miscellaneous businesses to his current business, presently he transported his commercial to harbors with the investments in container port facilities around the world, including in Hong Kong, Canada, China, The United Kingdom, Rotterdam, Panama, Bahamas, and many others countries. Li also Forayed into the technology business. One of his company, Horizons Ventures, an investment and venture capital company, which specifically backs new internet and technology startup companies, purchase the stake in doubt Twist, a digital. His major works are the foundation of Cheung Kong productions in the 1950s as a plastics manufacturer. The company eventually expanded and diversified into various other fields and evolved into Cheung Kong (Holdings) Limited in the years of the 1970s. It is one of Hong Kong’s leading multi-national conglomerates which operates in more than 50 countries and employers which are more than 240,000 staff worldwide. Li Ka-Shing is a notable giver and has given millions to instructive organizations, clinics, and other worthwhile motivations everywhere on over the world through the Li Ka Shing Foundation which he set up in 1980. He gave HK$100 million to the Hong Kong Polytechnic University in 2001 after which a pinnacle in the college was named after him. He made a £5.3 million gift to the University of Cambridge, which in 2002 initiated the Li Ka Shing Center which houses a Cancer Research UK office. He contributed $100 million to the Lee Kuan Yew School of Public Policy at the National University of Singapore in 2007[2].

Henry Cheng:

Henry Cheng is a Hong Kong business person who has a total asset of $14 billion. Henry Cheng was conceived in Shunde, Guangdong, China in 1946. He is the child of Cheng Yu-tung who established New World Development. Henry Cheng moved on from the University of Western Ontario and is presently the director of New World Development and Chow Tai Fook Jewelry which is the world’s biggest diamond setter. He is additionally the director of New World Chain Land, NWS Holdings, New World Department Store China, and Taifook Securities. Cheng is a Standing Committee Member of the Eleventh Chinese People’s Political Consultative Conference. He was the first to offer his help to Secretary for Development of China Paul Chan was engaged with an embarrassment. He has four kids including business visionary Adrian Cheng.

In 2005 Henry Cheng and Vincent Lo were sued for $1 billion by Donald Trump. Cheng joined a consortium putting resources into I-Cable in 2017. Henry owns about 67% stake in Chow Tai Fook Jewelry as well as a 33% stake in New World Development. All the credit goes to Cheng which did all for the siblings and became the chairman. Cheng also owns 75% of Chow Tai Fook Enterprise and 18% of Giordano international and 2% of Ping An Insurance[3].

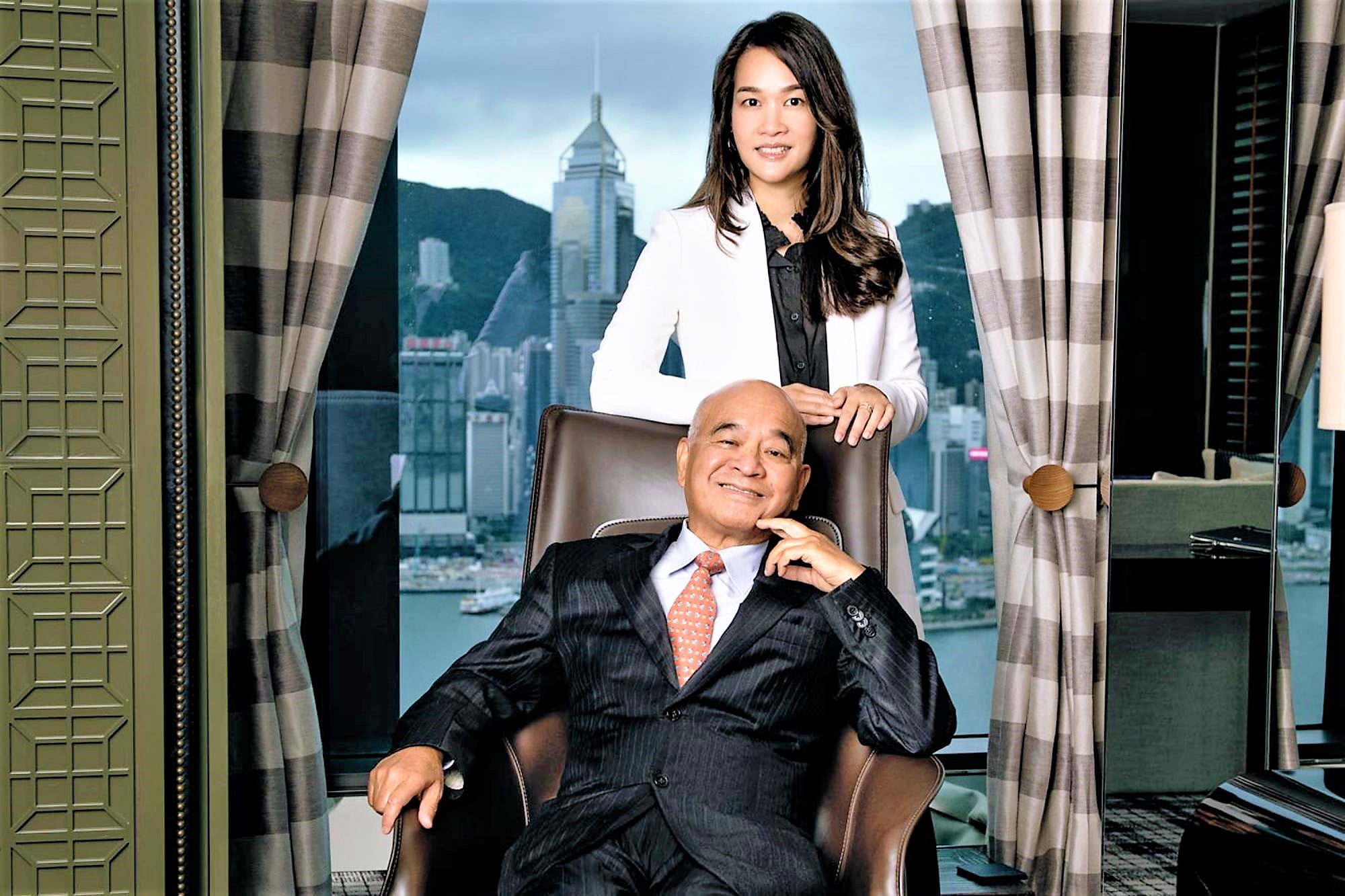

Joseph Lau:

Joseph Lau is a Hong Kong land speculator who has a total asset of 7.2 billion dollars. Conceived in 1951 in Hong Kong, China, Joseph Lau had a 61% stake in Chinese Estates Holdings, a significant Chinese venture holding organization situated in Hong Kong, China—its auxiliaries mainly captivating in property speculation and advancement, business, protections venture, and cash loaning. It was uncovered in 2007 that Lau was among the first of seven buyers of a Boeing 787 Dreamliner stream for his private use and as per the Sunday Times, Lau likewise claims one of the world’s best red wine assortments, with at any rate 10,000 containers. He is otherwise called an ardent workmanship authority. Lau wedded Bo Wing-Kam in 1954 and the couple separated in 1992. They had two youngsters, a child (brought into the world 1980) and a little girl (brought into the world 1982). In 2001, Lau met a lady numerous years his lesser, Yvonne Lui, and the couple had a little girl (brought into the world 2003) and a child (brought into the world 2010)[4].

During the subsequent marriage, Lau additionally carried on a relationship with Chan Hoi-wan and the pair had a girl (brought into the world 2008) and a child (brought into the world 2012). That very year, Lau and previous public works boss Ao Man-long were engaged with a payoff and illegal tax avoidance case, in which both were denounced, and a preliminary was set for 2012-13. In January 2013, it was declared that the preliminary would be deferred (a subsequent time) after Lau’s lawyer revealed that Lau was sick. The preliminary purportedly went ahead in mid-2013 without the charged Joseph Lau during beginning procedures. In 2014, Joseph Lau ventured down as executive and CEO of Chinese Estates Holdings of Hong Kong after he was seen as blameworthy of pay off and tax evasion charges in March of 2014[4].

References:

1. praboook. 17th September 2020; Available from: https://prabook.com/web/lee.shau-kee/520425

2. thefamouspeople. 17th September 2020; Available from: https://www.thefamouspeople.com/profiles/li-ka-shing-6420.php

3. celebritynetworth. 17th September 2020; Available from: https://www.celebritynetworth.com/richest-businessmen/richest-billionaires/henry-cheng-net-worth/

4. celebritynetworth. 17th September 2020; Available from: https://www.celebritynetworth.com/richest-businessmen/richest-billionaires/joseph-lau-net-worth/