Reason Of News:

The stock market shed its positive fervor on Tuesday, when by the end, therefore, the KSE-100 benchmark had fallen by 392 marks or 0.90 percent to 43,283. [1] Here, we will discuss that why and how PXS Loses 392 Points on Profit Selling.

Report and Analysis:

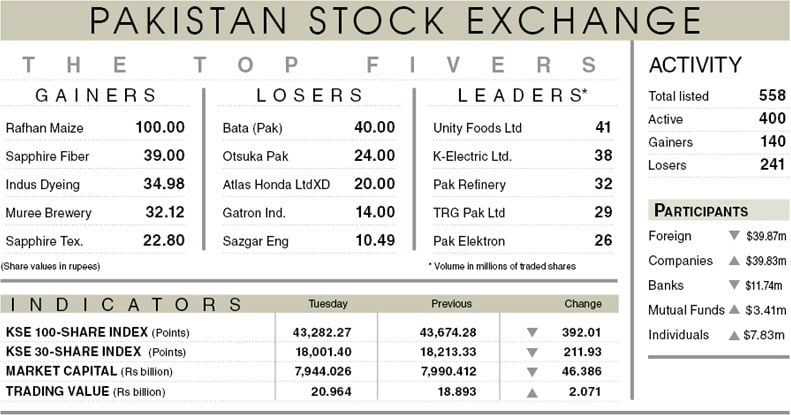

The KSE-100 indicator was opened in a constructive extension of the previous day’s earnings. It soared to an intraday peak of 238 points, but by midday, the index had bowed to sales pressure as second and third cement, steel, and innovation favorites had been rated as over-purchased as most of them had hit their 52-week high. Analysts at Arif Habib Ltd said: “The market was driven by the market-to-market activity of the institutions as well as the profit booking.” Investors are said to have used benefit booking in the discovery & development, banking, cement, power, and pesticide sectors in the expectation of repurchasing at lower prices. [1]

I observed that unceasing global sales, increasing electricity tariffs, a supply shortage for the manufacturing sector, and market fears about continuing political instability have played a catalytic role in bearish closeness. Although the Covid-19 cases have abated in the last few days, Pakistan announced the first confirmed case of a new and more infectious virus variant found in the United Kingdom. It weighed on investor expectations who were wondering about another round of lock-ups and shutdowns that could dampen the market and economic development and dent company transparency. [1]

Conclusion:

Traded volumes increased from 8.1pc to 503 million shares on the previous day, while the traded value increased from 11pc to Rs20.96 billion. The king of the day’s value was Solidarity, where 41.3m of shares changed hands. Scripts that brought the index down included Habib Bank Ltd down 63 points, MCB Bank Ltd 42 points, Hub Power Corporation 42 points, United Bank Ltd 38 points, and Engro Corporation 35 points, which together took a toll of 220 points. [1] So, the PXS Loses 392 Points on Profit Selling.

Reference:

Source: Published in Dawn, December 30th, 2020